In the dynamic world of finance, mastering how2invest in stocks is a fundamental skill for financial success. For beginners eager to navigate the intricacies of the stock market, this comprehensive guide will equip you with the essential knowledge and strategies needed to embark on your how2invest journey.

Understanding the Basics of How2Invest in Stocks

What are Stocks?

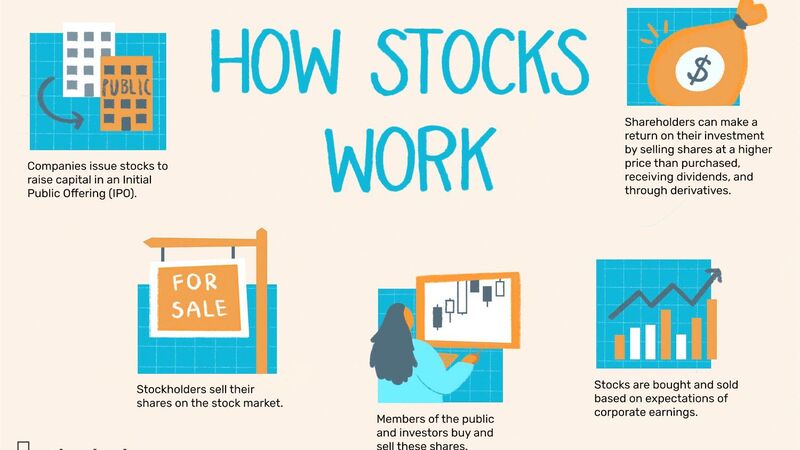

Discover how2invest in stocks, also known as equities, representing ownership in a company. Distinguish between common and preferred stocks, and explore the different types of stocks available.

Stock Exchanges

Learn how2invest by gaining a solid understanding of major stock exchanges such as the NYSE and NASDAQ. Uncover how stocks are traded in the market.

Setting Financial Goals for Successful How2Invest

Identifying Financial Objectives

Begin your how2invest journey by establishing clear financial goals and objectives to guide your investment strategy.

Determining Investment Time Horizon

Assess your investment time horizon to align your portfolio with your long-term or short-term how2invest goals.

Assessing Risk Tolerance

Understand how2invest by assessing your risk tolerance, enabling you to make informed decisions about the level of risk you are comfortable taking on.

Research and Analysis: The Key to Informed How2Invest

Company Research

Learn how2invest by analyzing a company’s financial statements and performance. Explore growth prospects to make informed investment decisions.

Economic and Market Analysis

Stay ahead of the curve by understanding industry trends, economic indicators, and conducting risk analysis in your how2invest journey.

Types of Investment Strategies

Explore various how2invest strategies, from long-term investing with buy-and-hold approaches to short-term trading strategies like day trading and swing trading.

Building a Diversified How2Invest Portfolio

The Importance of Diversification

Discover how2invest by understanding the significance of diversification in minimizing risk and maximizing returns.

Allocating Assets

Learn how2invest by understanding how to allocate assets across different sectors and industries to create a well-balanced portfolio.

Investment Tools and Platforms for Successful How2Invest

Online Brokerage Accounts

Explore popular online brokerage accounts, stock trading apps, and robo-advisors to find the right platform for your how2invest journey.

Risk Management for a Secure How2Invest Journey

Setting Stop-Loss Orders

Implement how2invest risk management techniques like setting stop-loss orders to protect your investments.

Regular Portfolio Review

Learn how2invest by understanding the importance of regularly reviewing and rebalancing your portfolio to adapt to market changes.

Emergency Funds and Liquidity

Understand how2invest by recognizing the role of emergency funds and liquidity in managing unforeseen financial challenges.

Monitoring and Adjusting for Long-Term How2Invest Success

Regular Tracking of Stock Performance

Stay informed about your how2invest stock portfolio’s performance by regularly tracking it against your financial goals.

Staying Informed

Emphasize the importance of staying informed about market trends and making adjustments to your how2invest strategy accordingly.

Conclusion: In conclusion, this how2invest guide provides a solid foundation for beginners eager to learn how to invest in stocks. Armed with this knowledge, you can confidently navigate the stock market and work towards achieving your financial goals through how2invest strategies. Remember, investing is a continuous learning process, so stay informed, stay vigilant, and start your how2invest journey with confidence.

please read more information about investment: how2invest